Updated 04/2025

Budgeting doesn’t have to be complicated. The 50/30/20 rule is one of the simplest and most effective budgeting methods, providing a clear framework for managing your finances. Whether you’re just starting your financial journey or looking for an easy way to gain better control of your money, this rule can help.

In this guide, we’ll explain what the 50/30/20 rule is, where it came from, how to apply it in everyday life, and whether it’s the right fit for you.

What Is the 50/30/20 Rule?

The 50/30/20 rule is a simple yet effective budgeting method. It was introduced to the mainstream by Sen. Elizabeth Warren and her daughter Amelia Warren Tyagi in their 2005 book “All Your Worth: The Ultimate Lifetime Money Plan.” The authors designed it as a balanced, no-nonsense way to manage money without complicated tracking.

The approach is based on decades of financial research and aims to help people avoid the all-too-common cycle of living paycheck to paycheck.

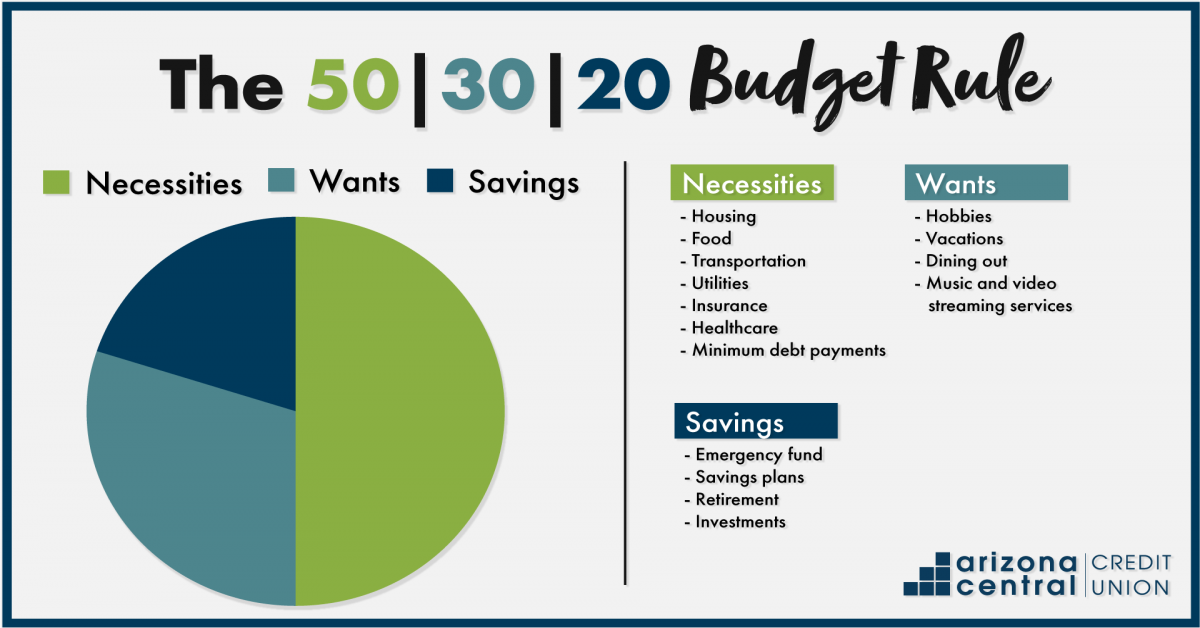

This rule divides your after-tax income into three main categories:

50% for needs

Essential expenses are those required for daily living, such as housing, utilities, groceries, insurance, transportation, and minimum debt payments.

While it may be easy to conflate the needs and wants category, it’s important to remember that the needs category is meant for things essential for survival.

30% for wants

Discretionary spending goes to things that improve your quality of life, such as dining out, entertainment, hobbies, streaming services, travel, and luxury purchases.

It’s important to remember that it’s OK to spoil yourself as long as you do so in a financially responsible way.

20% for savings and debt repayment

This is money set aside for financial security, including emergency savings, retirement contributions, investments, and extra payments toward debts beyond the minimum.

There are a variety of savings accounts that will help you accomplish your savings goals. Short-term savings goals like saving for a vacation can go into your standard savings accounts. Emergency funds are a variation of a savings account designed to keep you financially stable when life throws you a curveball.

How to Implement the 50/30/20 Rule

1. Calculate your after-tax income

Your after-tax income is what remains after federal, state, and local taxes, as well as deductions like Social Security and Medicare. If you’re self-employed, subtract your estimated tax payments.

2. Break it down by category

Once you know your after-tax income, apply the percentages, using this example:

- 50% needs: If you earn $5,000/month after taxes, you should allocate $2,500 to housing, food, transportation, insurance, and minimum loan payments.

- 30% wants: Set aside $1,500 for entertainment, dining, hobbies, or travel.

- 20% savings and debt: Put at least $1,000 toward savings and extra debt payments.

| Category | Total Monthly Income X Category | Category Limit |

|---|---|---|

| Needs | $5,000 X 0.50 | $2,500 |

| Wants | $5,000 X 0.30 | $1,500 |

| Savings | $5,000 X 0.20 | $1,000 |

3. Adjust based on your situation

If your essential expenses exceed 50%, you may need to cut costs or adjust spending in the wants category. If you can save more than 20%, that’s even better for your financial future.

4. Use budgeting tools

Apps like YNAB, Mint, and EveryDollar can help automate and track your budget, making it easier to stay on course.

Is the 50/30/20 Rule Right for You?

While the 50/30/20 rule is a great starting point for many, it may not be the best fit for everyone. Your financial situation, cost of living, and personal goals play a major role in determining whether this method works for you.

Who benefits most from the 50/30/20 rule?

This rule is especially useful for:

- Beginning budgeters: If you’re new to managing money, this method provides an easy-to-follow structure without requiring meticulous tracking.

- People with a steady income: If you earn a consistent paycheck, dividing your money into fixed percentages is simple and effective.

- Those looking for balance: The 50/30/20 rule allows for responsible budgeting while still leaving room for fun and discretionary spending.

Who might need to adjust the rule?

Although this budgeting method works well for many, some individuals may need to modify it based on their circumstances:

- High-cost living areas: If you live in a city with expensive rent and necessities, 50% for needs may not be enough. You might need to adjust to 60/20/20 or even 70/20/10 to account for higher living costs.

- High debt load: If you’re aggressively paying off student loans or credit card debt, you may want to shift more money into the savings and debt repayment category.

- Variable income earners: Freelancers, gig workers, commission-based employees and others with a variable income may need a more flexible approach. You should set aside a larger portion of your income for savings to cover months with lower earnings.

- Early retirement seekers: If you’re working toward financial independence and retiring early (FIRE movement), you may want to increase your savings rate well beyond 20%.

Alternatives to the 50/30/20 rule

If this rule doesn’t quite fit your needs, consider these alternatives:

- 60/20/20 rule: For those with higher essential expenses, allocating 60% to needs, 20% to wants, and 20% to savings can provide a more realistic approach.

- Zero-based budgeting: In zero-based budgeting, every dollar is assigned a job, meaning no unallocated money is left at the end of the month. This method is great for those who want more control over their spending.

- 80/20 rule: A simpler approach where you save 20% and spend the remaining 80% however you choose.

Take Control of Your Budget With AZCCU’s Help

The 50/30/20 rule is a practical starting point for managing your money with ease. It ensures you meet financial obligations while still enjoying life and building wealth. However, as the financial landscape evolves, it’s important to stay flexible and adjust your budget as needed.

Arizona Central Credit Union offers a range of financial services. Whether you are in the market for a low-interest rate credit card, mortgage, student loan or have general financial-related inquiries, our financial experts can help. If you have any questions, contact AZCCU online or call (866) 264-6421.