American consumers favor cards as their preferred payment method. According to the 2019 Diary of Consumer Payment Choice conducted by the Federal Reserve, debit cards were the most used form of payment, accounting for 28% of all payments. Credit cards were slightly behind, accounting for 23% of all payments. While most consumers have chosen plastic over paper for their preferred payment method, there are a handful of differences between credit and debit cards that are important to understand before heading off on a spending spree.

Some of the key differences to note are how the funds are originated and deducted from your account, the fraud protection provided with each card, the various fees, the different types of credit and debit cards you can obtain and much more.

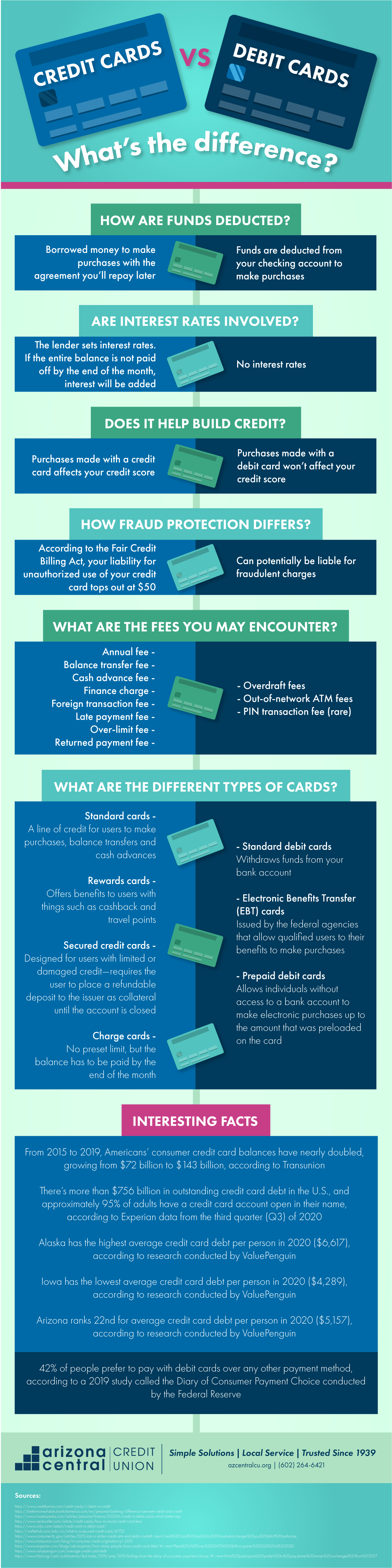

With e-commerce growing 32.4% in 2020, according to the United States Department of Commerce, card payments appear to be the payment option of the future. The infographic below highlights the stark differences between credit and debit cards and how to use each one for specific purchases.

Credit Vs. Debit: What’s The Difference Content

The differences between credit and debit cards are subtle but noticeable. Here are how the two monetary pieces of plastic differ from each other.

How Are the Funds Deducted?

- Credit Cards: Borrowed money to make purchases with the agreement you’ll repay later

- Debit Cards: Funds are deducted from your checking account to make purchases

Are Interest Rates Involved?

- Credit Cards: The lender sets interest rates. If the entire balance is not paid off by the end of the month, interest will be added

- Debit Cards: No interest rates

Does the Card Help Build Credit?

- Credit Cards: Purchases made with a credit card affects your credit score

- Debit Cards: Purchases made with a debit card won’t affect your credit score

How Does Fraud Protection Differ?

- Credit Cards: According to the Fair Credit Billing Act, your liability for unauthorized use of your credit card tops out at $50

- Debit Cards: Can potentially be liable for fraudulent charges

What Are the Fees You May Encounter?

- Credit Cards: There may be specific fees involved when using a credit card. Those include:

- Annual fee

- Balance transfer fee

- Cash advance fee

- Finance charge

- Foreign transaction fee

- Late payment fee

- Over-limit fee

- Returned payment fee

- Debit Cards: There may be a few fees involved when using a debit card. Those include:

- Overdraft fees

- Out-of-network ATM fees

- PIN transaction fee (rare)

What Are Different Types of Credit Cards?

- Standard cards – A line of credit for users to make purchases, balance transfers and cash advances

- Rewards cards – Offers benefits to users with things such as cashback and travel points

- Secured credit cards – Designed for users with limited or damaged credit—requires the user to place a refundable deposit to the issuer as collateral until the account is closed

- Charge cards – No preset limit, but the balance has to be paid by the end of the month

What Are Different Types of Debit Cards?

- Standard debit cards – Withdraws funds from your bank account

- Electronic Benefits Transfer (EBT) cards – Issued by the federal agencies that allow qualified users to their benefits to make purchases

- Prepaid debit cards – Allows individuals without access to a bank account to make electronic purchases up to the amount that was preloaded on the card

Interesting Facts About Credit Cards and Debit Cards

- From 2015 to 2019, Americans’ consumer credit card balances have nearly doubled, growing from $72 billion to $143 billion, according to Transunion

- There’s more than $756 billion in outstanding credit card debt in the U.S., and approximately 95% of adults have a credit card account open in their name, according to Experian data from the third quarter (Q3) of 2020

- Alaska has the highest average credit card debt per person in 2020 ($6,617), according to research conducted by ValuePenguin

- Iowa has the lowest average credit card debt per person in 2020 ($4,289), according to research conducted by ValuePenguin

- Arizona ranks 22nd for average credit card debt per person in 2020 ($5,157), according to research conducted by ValuePenguin

- 42% of people prefer to pay with debit cards over any other payment method, according to a 2019 study called the Diary of Consumer Payment Choice conducted by the Federal Reserve

Learn More About Credit And Debit Cards

At Arizona Central Credit Union, we understand that banking and financial information can sometimes be complicated. Our financial professionals are here to help you, no matter your level of financial literacy. We offer a range of financial services. Whether you are in the market for a low-interest rate credit card, mortgage, student loan or have general financial-related inquiries, our financial experts can help. Contact us if you have questions or would like to open a bank account.