Do you find that you reach the end of the month with almost no money left over, or are you having little success saving up for a car or other big purchase? If you’re struggling with overspending, embracing a budgeting method may help you to get control of your personal finances.

Think of a budget as some extra guidance to help you keep an eye on your spending each month. Budgets can help you to plan for both your needs and wants, so you’re better able to plan how to use your money so you have enough for all of your expenses. Since there are many types of budgeting methods to choose from, you can select the method that’s the best fit for your lifestyle and the specific spending challenges that you face.

Read on to learn about seven types of budgeting methods, their pros and cons, and which might be the best fit for you.

Why Is Budgeting Important?

Budgeting is a fantastic tool that can help you to take control of your finances. When you create a budget, you can better understand your current spending habits and can identify areas where you may be overspending. Then, you’ll be able to take steps to change those habits and spend and save your money more wisely.

A budget gives you a set of rules to guide your spending. These rules can help to keep you accountable and make you more aware of how you’re spending money. Ultimately, by building strategic spending habits, you can work toward achieving your personal finance goals and establishing short- and long-term financial health.

7 Types Of Budgeting Methods

These seven types of budgeting methods each take a slightly different approach to helping you to strategically save and spend your money. Each method has different pros and cons, so consider which will best meet your needs and your personal finance goals.

1. 50/30/20 rule

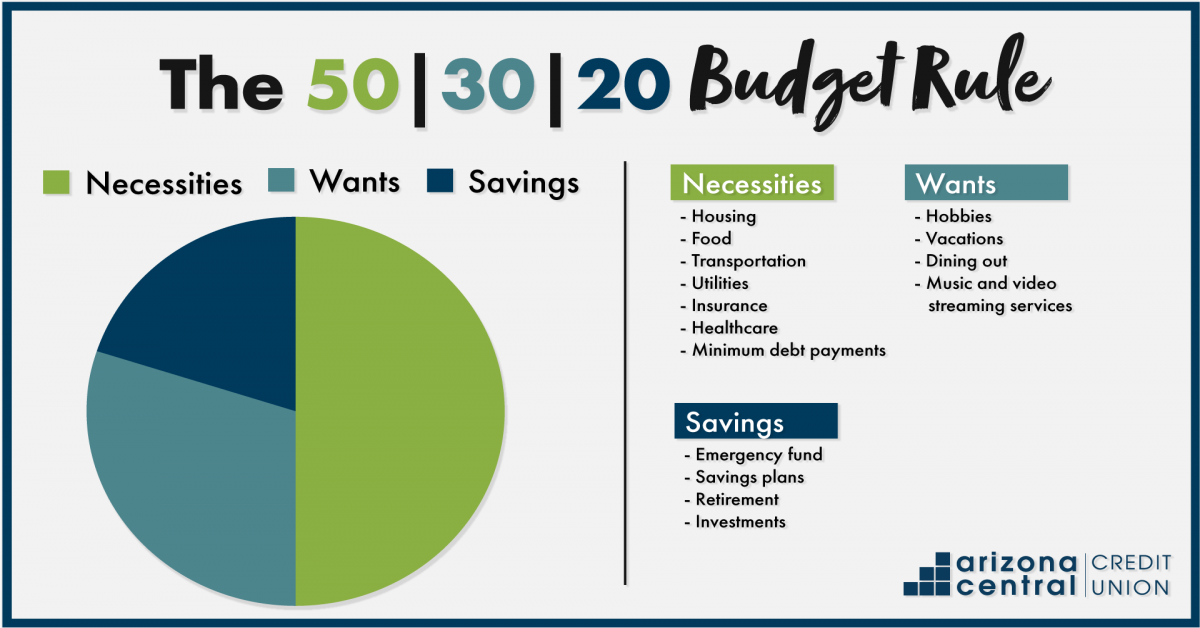

The 50/30/20 rule is a personal budgeting technique that divides your income into necessity, wants, and savings categories. The rule helps you to ensure that you can pay for your monthly expenses while still having some money left over to put into savings. Implementing the rule is simple and easy, and while it helps you budget, it still gives you a lot of financial freedom.

2. Zero-based budgeting method

If you find that you often overspend, the zero-based budgeting method might be right for you. With this budgeting method, you will assign every dollar that you make each month to an expense or saving for future needs. At the end of the month, after you’ve subtracted each expense, your total will be zero, meaning there is no money leftover that hasn’t been given a purpose. This method can be a great way to see exactly how you’re spending and saving money.

3. Envelope budgeting system

The envelope budgeting system is a hands-on system where you take out your paychecks in cash, then physically divide up the money into different envelopes. By creating a separate envelope for your needs, savings, and wants, you can separate your cash and save for expenses. You can make the process even more specific by adding envelopes for items like entertainment, clothes, dining out and more.

4. Line-item budget approach

Using the line-item budget approach, you will create a spreadsheet that includes all of your estimated monthly expenses. You can make the spreadsheet highly detailed, such as by breaking down housing costs into rent, utilities, internet, TV, and more.

You can create a monthly line-item budget, then input your actual expenses in a separate column. This approach helps you to plan out your spending and to compare your actual spending to identify areas where you overspent.

Creating a line-item budget doesn’t require any specialized skills, and it’s a good way to keep track of where your money goes each month. While the spreadsheet only shows information about your estimated costs and the money that you spent, you will need to be able to reflect on why you overspent and identify ways to prevent that from happening in future months.

5. Pay-yourself-first budgeting method

Other types of budgets often have you set money aside for items like bills, entertainment, and dining out. But with the pay-yourself-first budgeting method, you prioritize the savings categories that are most important to you, like contributing to your retirement fund, before you budget for other wants.

To start, you’ll need to calculate your monthly income and decide on your savings goals, whether you’re saving to buy a house or want to boost your retirement savings. Then, you’ll need to decide how much money you want to put toward that priority savings goal each month, and how much money you will have left over for other expenses.

The pay-yourself-first budgeting method can help you to focus on your long-term savings goals and ensures that you’re able to regularly contribute to those savings. However, it’s important to make sure that you also set aside enough money for unexpected expenses, since you’ll want to avoid having to withdraw money from your savings for emergencies.

6. Proportional budgeting approach

With a proportional budgeting approach, you will divide your income into different categories, and each category will make up a certain percentage of your income. The 50/30/20 rule above is an example of proportional budgeting.

You don’t have to stick to the 50/30/20 rule, though. With proportional budgeting, you can design the categories and proportions that work best for your needs. You can add and subtract categories, like housing, food, child care, transportation, paying off debt, traveling, dining out, and more.

This budgeting approach gives you flexibility in how you decide to budget your money, but if you need strong rules to help you avoid overspending, this might not be the right budgeting method for you.

7. 60/40 budgeting rule

The 60/40 budgeting rule is a simple way to put a stop to overspending. This rule allocates 60% of your gross income to essential expenses, like rent, insurance, transportation, utilities, and groceries. The remaining 40% of your gross income goes toward non-necessities.

Since 40% of your income is a lot of money to have left over, it can be helpful to divide that 40% into different categories, like entertainment, short-term savings, and long-term savings.

This rule is straightforward and is one that you can easily implement right away without significant planning. It gives you flexibility in how you spend the remaining 40% of your income, but you might find that a little more structure may help to guide your spending.

Learn More About Budgeting And Personal Finance

Finding a budget method that works for you can help you to take charge of your income and spending. The more you understand about your spending habits, the better you can work toward your personal finance goals, like saving for a home or building your retirement savings.

If you’re interested in learning more about budgeting and personal finance tips, check out some of our recent articles below:

- How to Save Money in a Recession: Learn how to save money during a recession so you can be better equipped to handle the economic uncertainty that comes with it.

- 7 Budgeting Apps to Help You Manage Your Money: Budgeting is an important factor in achieving financial freedom. Discover the seven of the best budgeting apps available on the market.

Financial Advice for Young Adults: Top Five Strategies: Young adults often struggle with financial literacy. In this article, we offer the best financial advice and strategies to help young adults.