If you’ve had your credit card for a while, you might want to make a larger purchase or get a credit limit increase. Your credit limit affects more than how much you can borrow. It also affects your credit utilization and can help you to maintain or get a higher credit score.

While your lender may periodically offer you a credit limit increase, you can take a more active role. Understanding how to increase your credit limit can help you to get the limit you need for your purchasing plans and build your credit score.

How Credit Limits Are Determined

When approved for a credit card, your lender sets a credit limit of the maximum balance you can carry. Your limit includes new purchases and balance transfers.

Every lender has their own methods of determining your credit limit. Rather than personalizing a limit based on your credit score, some lenders offer credit cards with a predetermined limit. For example, some student credit cards have set limits of $200 or $500. These low limits help to minimize the risk the lender assumes while giving the student a chance to build their credit.

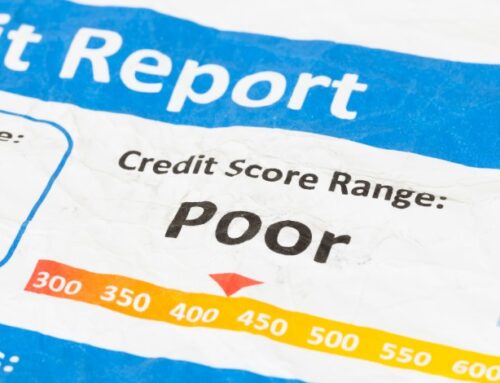

Alternatively, lenders may calculate credit-based limits by using your credit score to evaluate your financial responsibility and ability to repay your balance. Your lender may review factors like your payment history, length of your credit history, and household income to determine your limit. Some lenders will take an even broader approach to customize your credit limit, and they may review information like the limits of your other credit cards and your debt-to-income ratio.

Each lender also has their own guidelines for credit limit increases. While the criteria for increases will depend on your lender, most lenders will require you to be a cardholder for at least six months before being eligible for an increase. You can also only request an increase once every six months.

Ways To Get A Credit Limit Increase

There are three ways to get a credit increase. They’re all pretty simple to navigate.

1. Self-initiated credit limit increase

You can ask for a credit increase. To start, you’ll need to log into your online credit account and find an option to request a credit line increase, or you can call your credit card issuer directly to request the increase.

You must provide some information, including your income and monthly living expenses. From there, your lender will review the information and decide whether to increase your credit line.

2. Automatic credit increase

Some credit card lenders automatically and periodically increase your credit limit. If you’ve demonstrated responsible lending habits and have reliably made payments on your credit card, your lender may increase your limit without requesting it.

3. Apply for a new credit card

If you’ve built up a history of responsible credit usage, you may be able to increase your credit limit by applying for a new card with a higher limit. When approving you for a new card, lenders often review your financial data, including your credit score and the limits of your existing credit lines. Your existing credit card can help to prove that you’re a trustworthy borrower, increasing your chances of being approved for a card with a higher limit.

Benefits Of Credit Limit Increase

There are many reasons for increasing your credit limit, even if you don’t plan on carrying a larger balance on your card:

- Boost your credit score: When you increase your credit limits, you will have a better credit utilization rate. Your credit utilization refers to the amount of your available credit that you’re using. Keeping your usage low, ideally below 30%, can improve or help to maintain your credit score.

- Make larger purchases: Increasing your credit limit can allow you to carry a larger balance if you plan to make a major purchase. Keep your credit card usage below 30% of your available credit. That lower utilization can help to maintain your credit score.

- Earn more rewards: If your credit card offers rewards, like a percentage back on certain purchases, increasing your credit limit can allow you to spend more each month, maximizing your rewards.

- Get better future lending terms: Increasing a credit limit can help to boost your credit score. With a higher credit score, you’re more likely to get good lending terms in the future, like lower interest rates. A better score can also increase your chances of being approved for a mortgage or auto loan.

- Get a bigger limit on a new card: Increasing your credit limit on your existing card can demonstrate that you use your card responsibly. If you decide to apply for a second card, your larger limit may increase your chances of being approved for a larger limit on that new card, too.

Things To Consider Before Requesting A Higher Credit Limit

While requesting a higher credit limit can be beneficial, it’s important to ensure this is the right decision for you. Some lenders will perform a hard credit inquiry before approving a higher limit, and that inquiry can bring down your credit score. When you request a higher limit, ask your lender if the process involves a hard inquiry.

If you’re considering requesting a higher limit, focus on paying your monthly statements on time to show that you’re a responsible borrower. Pay down more than the minimum on your credit cards, and try to use as little credit as possible. Make sure to keep your credit card account details, like your income information, up to date. Your lender may request that you review this information annually, and ensuring that it’s accurate can increase your chances of being approved for a higher credit limit.

Find A Low-Interest Rate Credit Card That Fits Your Financial Needs

A credit card can be valuable in building your credit and spending power. By responsibly using your card, you can apply for a credit limit increase, building your credit score and spending capacity.

Arizona Central Credit Union offers many credit card options, whether you’re looking for your first credit card or want to apply for another card. Learn more now, then contact us if you have any questions.