If you fear that you won’t be financially stable when it comes time to retire, don’t worry, you’re not alone. According to a recent Gallup poll, 46% of nonretired Americans believe they won’t be financially comfortable when they retire.

Many financial and retirement experts agree that you should have approximately 80% of your final pre-retirement annual income to enjoy a similar lifestyle during retirement.

That’s why no matter what stage of life you’re in, it’s never too early to start thinking about and preparing for retirement. Even a little contribution per month can significantly affect your future.

With numerous types of retirement plans, choosing the right one for you can get overwhelming. Even though you may already have an employer-sponsored plan, such as a 401(k), you may want to consider an Individual Retirement Account (IRA) as a supplemental plan to help you reach your retirement goals faster.

An IRA is a savings account that provides tax advantages for your retirement. There are various types of IRAs with varying rules. However, there are two common types of IRAs—Traditional IRA and Roth IRA.

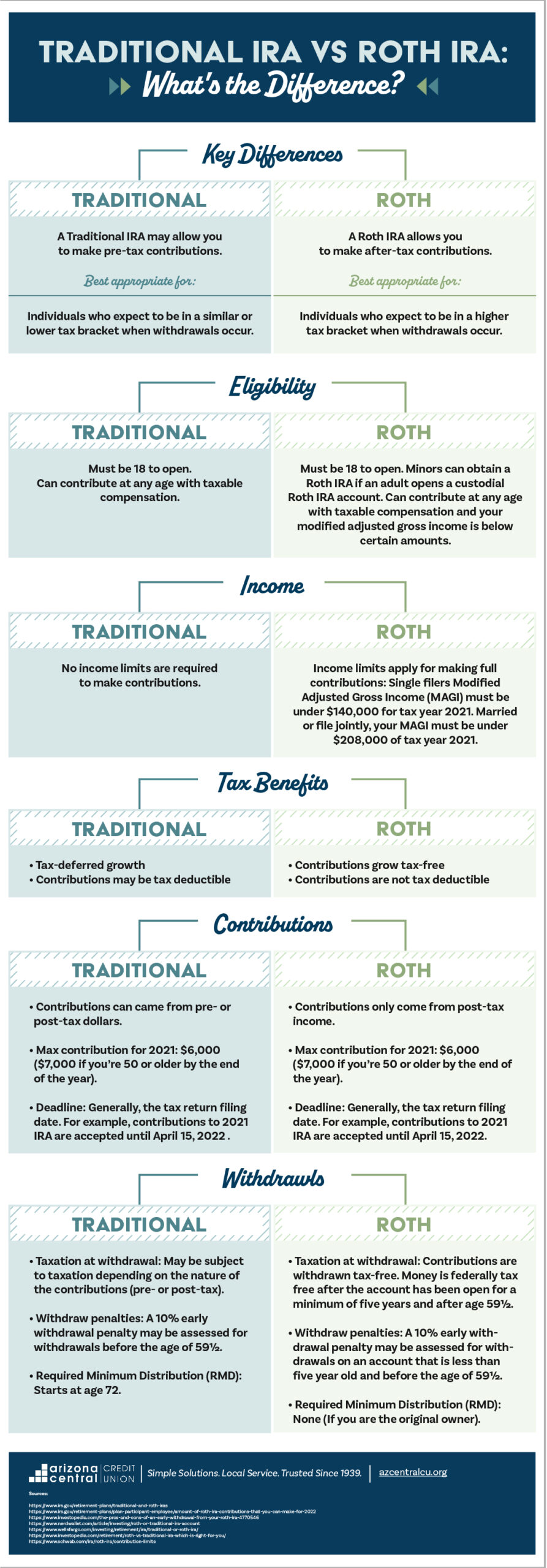

The following infographic will outline the key differences between a Traditional IRA and a Roth IRA. We’ll highlight the benefits of each to help you determine which one aligns with your specific retirement goals.

Traditional IRA Vs. Roth IRA: What’s The Difference? [Content]

A Traditional IRA and a Roth IRA each come with advantages and disadvantages. Let’s delve into the specifics of both to help you determine which one is right for you.

The main difference between Roth and Traditional IRA

- Traditional IRA: May allow you to make pre-tax contributions. Best suited for individuals who expect to be in a similar or lower tax bracket when withdrawals occur.

- Roth IRA: Allows you to make after-tax contributions. Best suited for individuals who expect to be in a higher tax bracket when withdrawals occur.

Traditional IRA vs. Roth IRA eligibility

- Traditional IRA eligibility requirements : Must be 18 to open. Can contribute at any age with taxable compensation.

- Roth IRA eligibility requirements: Must be 18 to open. Minors can obtain a Roth IRA if an adult opens a custodial Roth IRA account. Can contribute at any age with taxable compensation, and your modified adjusted gross income is below certain amounts.

Traditional IRA income limits vs. Roth IRA income limits

- Traditional IRA income limits: No income limits are required to make contributions.

- Roth IRA income limits: Income limits apply for making full contributions: Single filers Modified Adjusted Gross Income (MAGI) must be under $140,000 for tax year 2021. Married or filed jointly, your MAGI must be under $208,000 of tax year 2021.

Traditional IRA tax benefits vs. Roth IRA tax benefits

- Traditional IRA tax benefits: Tax-deferred growth and contributions may be tax-deductible.

- Roth IRA tax benefits: Contributions grow tax-free but are not tax-deductible.

Traditional IRA contributions vs. Roth IRA contributions

- Traditional IRA contributions: Contributions can come from Pre- or post-tax dollars. The max contribution for 2021 is $6,000 ($7,000 if you’re 50 or older by the end of the year). The deadline generally occurs on the tax filing date. For example, contributions to the 2021 IRA are accepted until April 15, 2022.

- Roth IRA contributions: Contributions only come from post-tax income. The max contribution for 2021 is $6,000 ($7,000 if you’re 50 or older by the end of the year). The deadline generally occurs on the tax filing date. For example, contributions to the 2021 IRA are accepted until April 15, 2022.

Traditional IRA withdrawal rules vs. Roth IRA withdrawal rules

- Traditional IRA withdrawal rules: Taxation at withdrawal: May be subject to taxation depending on the nature of the contributions (pre- or post-tax). Withdraw penalties: A 10% early withdrawal penalty may be assessed for withdrawals before the age of 59½. Required Minimum Distribution (RMD): Starts at age 72.

- Roth IRA withdrawal rules: Taxation at withdrawal: Contributions are withdrawn tax-free. Money is federally tax-free after the account has been open for a minimum of five years and after age 59½. Withdraw penalties: A 10% early withdrawal penalty may be assessed for withdrawals on an account that is less than five years old and before the age of 59½. Required Minimum Distribution (RMD): None (If you are the original owner).

Save For Retirement With Arizona Central Credit Union

At Arizona Central Credit Union, our goal is to make saving for retirement easy on you. We offer benefits that big banks can’t. With our various IRA options, you can choose one that aligns with your retirement goals. Contact us today to discover how we can help you head into your golden years with confidence.

Help decide what might be best for you with this Roth or Traditional 401(k) Calculator.