Enhancing Your Experience

eBRANCH Online Banking access is restored.

Zelle® is available. (Accounts are not suspended, simply select an account to proceed with transactions.)

Online Account Opening, Online Loan Applications are available.

- iTM functionality is currently unavailable.

- Glendale Ave. branch Walk Up ATM continues to be unavailable.

- Instant issue cards are unavailable until further notice.

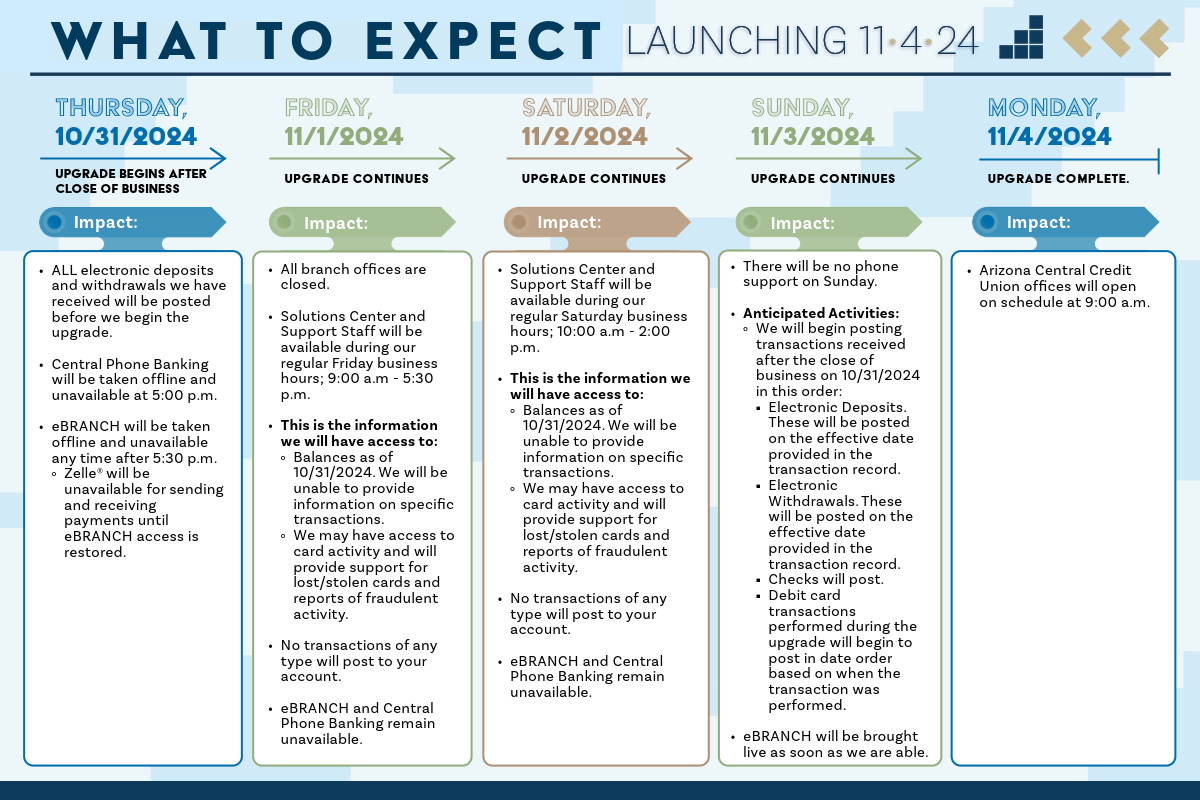

One of Arizona Central Credit Union’s primary goals is to provide you with competitive and innovative offerings so we remain your primary financial services partner. To ensure we deliver and achieve these goals, we have deployed a significant technology upgrade; live on November 4, 2024. This upgrade is essential for an enhanced member experience in the future.

There are three key events that you need to be aware of:

Our Offices are closed on Friday 11/1/24; we will be available by phone on Friday 11/1 and Saturday 11/2 during regular business hours.

Beginning any time after 5:30 p.m. Thursday 10/31/24 eBRANCH and Central Phone Banking will be unavailable until the upgrade is complete.

Effective at the close of business on 10/31/24 Zelle® and Funds transfers will not be available until eBRANCH access is restored. Please make sure you notify regular payees/payers of this service interruption. Funds others have sent to you will not go through while the service is suspended and the sender will be notified.

We realize this service disruption may cause frustration and will do everything possible to limit its overall impact for you.

Your trust and confidence are our number one priority, thank you for your ongoing support of our credit union.

Technology Upgrade FAQs

We are upgrading our technology to provide the foundation for an enhanced member experience in the future. We believe the long-term benefits of this upgrade make these short-term inconveniences worthwhile.

Our branch offices are closed, but our support teams will be answering phones during our regular business hours on Friday, 11/1 and Saturday 11/2. Although we will not have access to all your account information during the upgrade, we are able to provide the following:

- Your account balances as of close of business on 10/31. We will not be able to provide specific transaction information.

- We will be able to address fraud alerts on your debit/credit cards and support lost/stolen reports.

- Remember, you may always report your card lost/stolen after regular business hours by calling our main number, 602-264-6421, and selecting that option from the phone menu.

We post updates to https://www.azcentralcu.org/technology-upgrade/ as we move through the upgrade process. This page is the best place to check status. We will also communicate by e-mail and post on social media channels.

eBRANCH and Central Phone Banking will be available once all transactions are posted ensuring your account information is up to date. This will happen as soon as we are able but anticipate this on 11/4.

We anticipate and are planning for an extremely high call volume on Monday, 11/4/24. If your call is not of an urgent matter, please be patient and obtain updates through our website or your favorite social media platform.

eBRANCH and Central Phone Banking will be taken offline after 5:30 p.m. on Thursday, 10/31. We strongly urge you to review your account history prior to that time on Thursday.

No. The team at Arizona Central Credit Union will oversee this upgrade from start to finish. The security of your information is priority #1.

Your debit/credit card will be functional at merchants and ATMs. We do suggest making a cash withdrawal at a branch or ATM on 10/31 as a precaution. Our ATMs will be online during the upgrade. Again, these transactions will not post to your account until the system is back online, including deposits made at the ATM.

We currently post all electronic deposits the day we receive them, which is often before the effective date of the transaction. All direct deposits, regardless of the effective date, will be posted to your account before we close on 10/31. The same strategy will be used for your loan payments as well. Thursday 10/31 will be a ‘normal’ processing day.

While the technology upgrade is in process, no transactions will post. At that time, we will post all deposits received after 10/31 first, then we will begin posting withdrawals. Withdrawals include payments, debit/credit card transactions and checks you have written. Rest assured deposits will be processed prior to any withdrawals/payments posting.

Temporary Product & Service Changes

Zelle®, Funds Transfers, and External Loan Payments through eBRANCH

Effective at noon on 10/31/24 these transfers will not be available until eBRANCH access is restored.

- Recommendation for Zelle® Users: Please make sure you notify regular payees/payers of this service interruption. Funds others have sent to you will not go through while the service is unavailable and the sender will be notified that the transfer was not completed.

Bill Pay through eBRANCH

Bill payments will go out as scheduled on 10/31. Payments scheduled to go out on 11/1 will process as soon as possible. Bill Pay will resume regular processing on 11/4. Payments are never sent on weekends.

- Recommendation: Review the payments you have set up and modify the date if these dates will impact your payment.

Scheduled Recurring Transfers, SRTs, in eBRANCH

SRTs will process normally on Thursday, 10/31. Credit Union staff will ensure SRTs scheduled for 11/1 through 11/4 are posted as soon as possible. Anticipate during the weekend.

- Recommendation: Review your SRTs scheduled for 11/1 through 11/4 and make a 1-time modification to the date(s) to 10/31 or 11/5 if you have concerns.

Mobile Deposit through eBRANCH

Mobile Deposits will process normally on 10/31. Any deposit made after the cutoff time will post to your account on 11/4.

- Recommendation: You may deposit your item at a branch or ATM until 5:30 p.m. on 10/31 and it will post to your account on 10/31.

Online Membership Services

This platform will be unavailable beginning 10/27/2024. This will ensure all applications are processed prior to launching the upgrade. This platform will be available on 11/5.

Loan Payments Made through our partner, SWBC.

Payments made by 1:30 p.m. on 10/31/2024 will be posted to your account on the 31st. Payments made after that time will be processed when the upgrade is complete and we begin posting transactions. Anticipate Sunday, 11/3/2024.

Statements

Certain products receive statements quarterly. Because the upgrade is not taking place at the end of a quarter, you will receive 2 separate statements for the 4th quarter, 2024. The first statement will be for account activity in October 2024. The second statement will be for account activity in November and December 2024. Quarterly statements will resume on 3/31/2025.

Quicken- WebConnect, Banking, Credit Card & Quickbooks

WebConnect, Banking will be unavailable beginning 10/31 any time after 5:30 p.m. until 11/5.

Permanent Product & Service Changes

Certificate Dividends

Currently, certificate dividends pay quarterly. Due to the upgrade, all certificate dividends will begin paying monthly in October, 2024.

Courtesy Pay (formerly ODP)

Fees will post as a separate transaction. The fee will include a description referencing the transaction for which it was assessed.